We recently discussed the rise in popularity of donor-advised funds (DAFs) as a major trend for nonprofit fundraising.

In 2018, the charitable assets in DAFs totaled $120 billion – up more than $50 billion from just five years ago. By 2020, that number jumped up to $160 billion, despite an increase in payouts during the pandemic.

Where does that leave us?

DAFS DURING THE ECONOMIC DOWNTURN

With a looming recession, the loss of donors is a top concern for most leaders in the nonprofit industry.

Ironically, DAF donors could be a major source of additional financial support during these challenging times.

For the first time, financial institutions are strongly encouraging their clients to make distributions from their DAFs. It appears that the fund managers realize COVID-19 is having a tremendous impact on nonprofit organizations and are encouraging their clients to help by donating the money they have already set aside for charity.

Fidelity Charitable announced that their DAF account holders have given more than $236 million in response to COVID-19 efforts.

In their annual giving report, they also shared that organizations who sign up for EFT/ACH electronic transfer of funds will receive information such as names, addresses and channel preferences from donors who have made recent distributions.

As you can see, now is the time to invest in targeting DAFs like never before. Financial institutions are pushing donors to distribute. Donors are even pushing other donors to distribute.

And nonprofits need to be doing the same. Here are seven suggestions your organization can implement to begin encouraging DAF distributions:

INVESTIGATE, IDENTIFY AND TARGET

1. Locate every DAF giver on your file

Your donor database will become your best friend right now. Once a donor has given from their DAF, make sure you identify them properly to avoid mis-categorizing them as a miscellaneous donor, or worse, a lapsed donor. We touch on this in more detail in our first DAF blog.

2. Reach out to them

Once you’ve identified your DAF donors, reach out to them directly. Be honest. Tell them the increased need your organization is experiencing and tell them that now is the time for an additional distribution. Use the COVID-19 crisis to create urgency and show them how your cause is relevantly dealing with the repercussions.

3. Create a campaign for DAF donors

Outline goals, milestones and deliverables to keep your organization focused, accountable, and on track.

4. Advertise the campaign in every channel

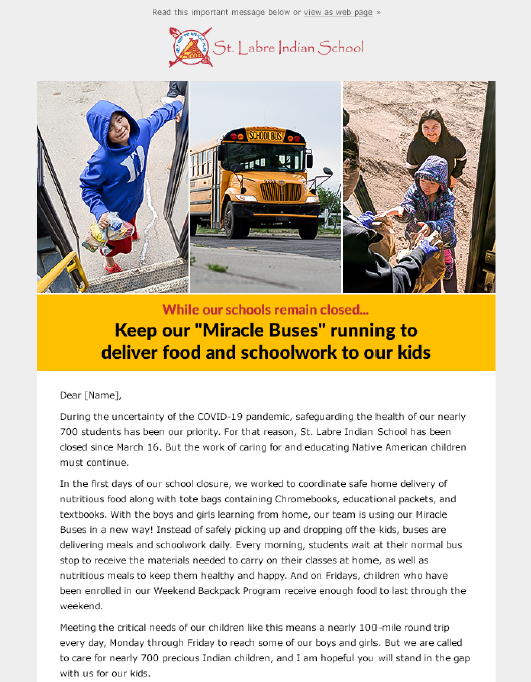

DAF messaging should not be restricted to any one channel. St. Labre Indian School recently included a P.S. in their COVID-19 email messaging with a special call to DAF donors. This is a great way to incorporate messaging throughout your other campaigns, too.

5. Make it easy to donate

Link to the DAF Direct widget everywhere. Make it prevalent on your website and in your donor communication. By providing a path to action for the donors, you won’t take the risk of the money sitting unused or going to another organization.

6. Give DAF donors special recognition

We all know it’s important to recognize your donors, and DAF donors are no different. In fact, to try to spur increased distributions, create a special society for DAF donors, complete with custom communication and reporting on the impact of their gift.

7. Offer incentives for making the DAF gift recurring

During uncertain times, recurring gifts will make your revenue stream much steadier. Many people are unaware that you can make a recurring DAF gift. Offer special status and recognition for these committed donors.

Donor-advised funds are continuing to grow. And now more than ever, nonprofits should focus on this important group of donors.

We know that the road ahead can be intimidating. But with a strategic plan to address these valuable donors, reminding them of the impact their DAF distributions will make in this time of crisis, you can set your organization up for long-term success.

Leave a comment: