When will fundraising return to normal for nonprofits?

That’s the big question on everyone’s mind as we begin to emerge from the COVID-19 pandemic.

As vaccination rates increase, we’re seeing a cautious reopening of society—from restaurants and businesses to concerts and sports. However, the Delta variant and other mutations may spoil things for everyone, leaving the future very much up in the air.

How can we plan budgets and investments in this environment? Thankfully, we’ve all gotten quite familiar with uncertainty over the past year.

Last August, I took a look at three scenarios of health and economic data to help nonprofits map out their fundraising plans. I estimated that charitable giving would likely return to pre-COVID levels by Q1 of 2023.

What no one could have predicted at the time was the remarkable speed with which scientists were able to create vaccines. Less than a year after discovering a novel virus, the medical community was able to develop effective vaccines for it—truly amazing to think about.

So what happens next for philanthropy?

Let’s dig into the data.

Economic factors look stable

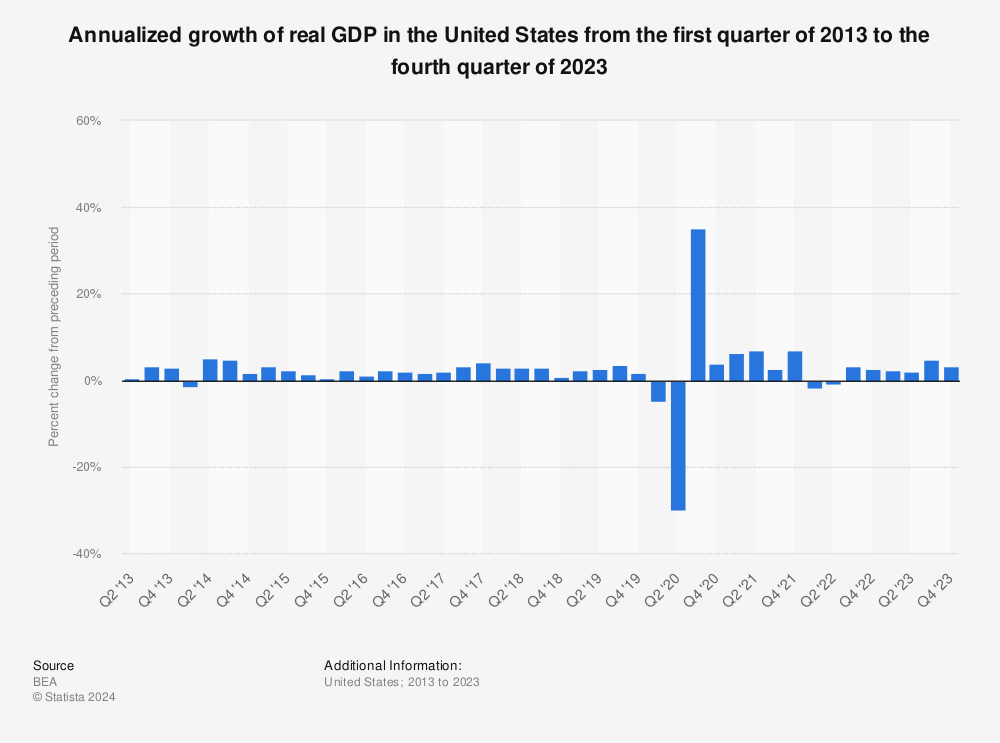

First, the U.S. economy has stabilized, thanks to a series of government stimulus actions and market adaptations. As quickly as the GDP tanked in Q2 2020 (-31.4%), it bounced right back in Q3 2020 (+33.4%). Even through the surge of coronavirus infections in the winter, the economy remained steady.

Looking ahead, there are no signs of a recession on the horizon. Supply and demand balances are a bit out of whack in several industries, but overall market signs are strong.

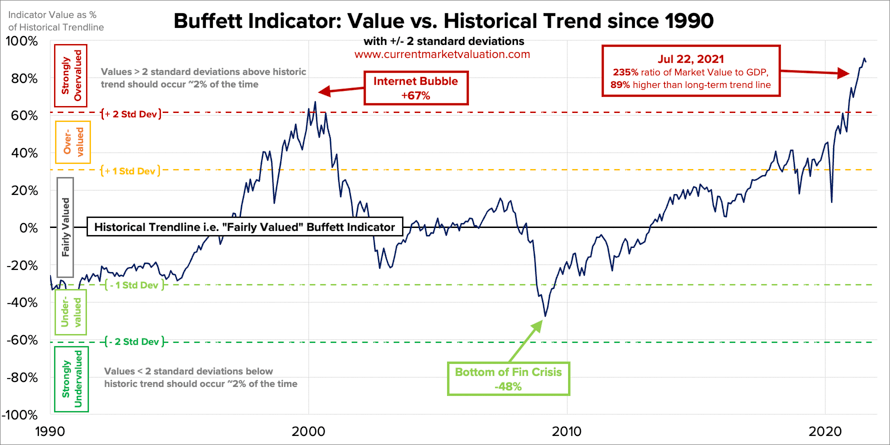

The Buffett Indicator—a ratio of stock market valuation to GDP—is typically a good gauge of an impending recession. It currently suggests the U.S. stock market is strongly overvalued, which might seem like prime time for a “bubble” to burst. However, interest rates remain at historically low levels, mitigating the risk of a market correction.

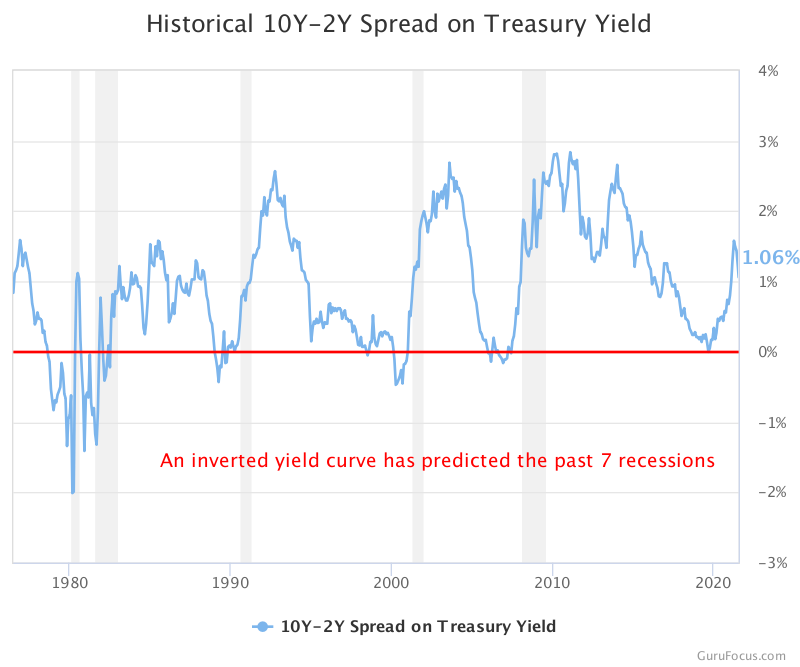

Another key indicator of economic trouble is the inverted yield curve, which has predicted the past seven recessions.

Typically, long-term debt has a higher interest rate because of the increased risk of long-term investments (think mortgages). But when economic conditions become unstable, investments become riskier, and the short-term interest rate rises above the long-term rate—thus inverting the yield curve.

As we look at the yield curve today, we see a slight turn downward in recent months but nothing that causes alarm.

With a stable economy—and the possibility of further government investment by the Biden administration—the X factor at the moment is the virus itself.

Variants could cause trouble

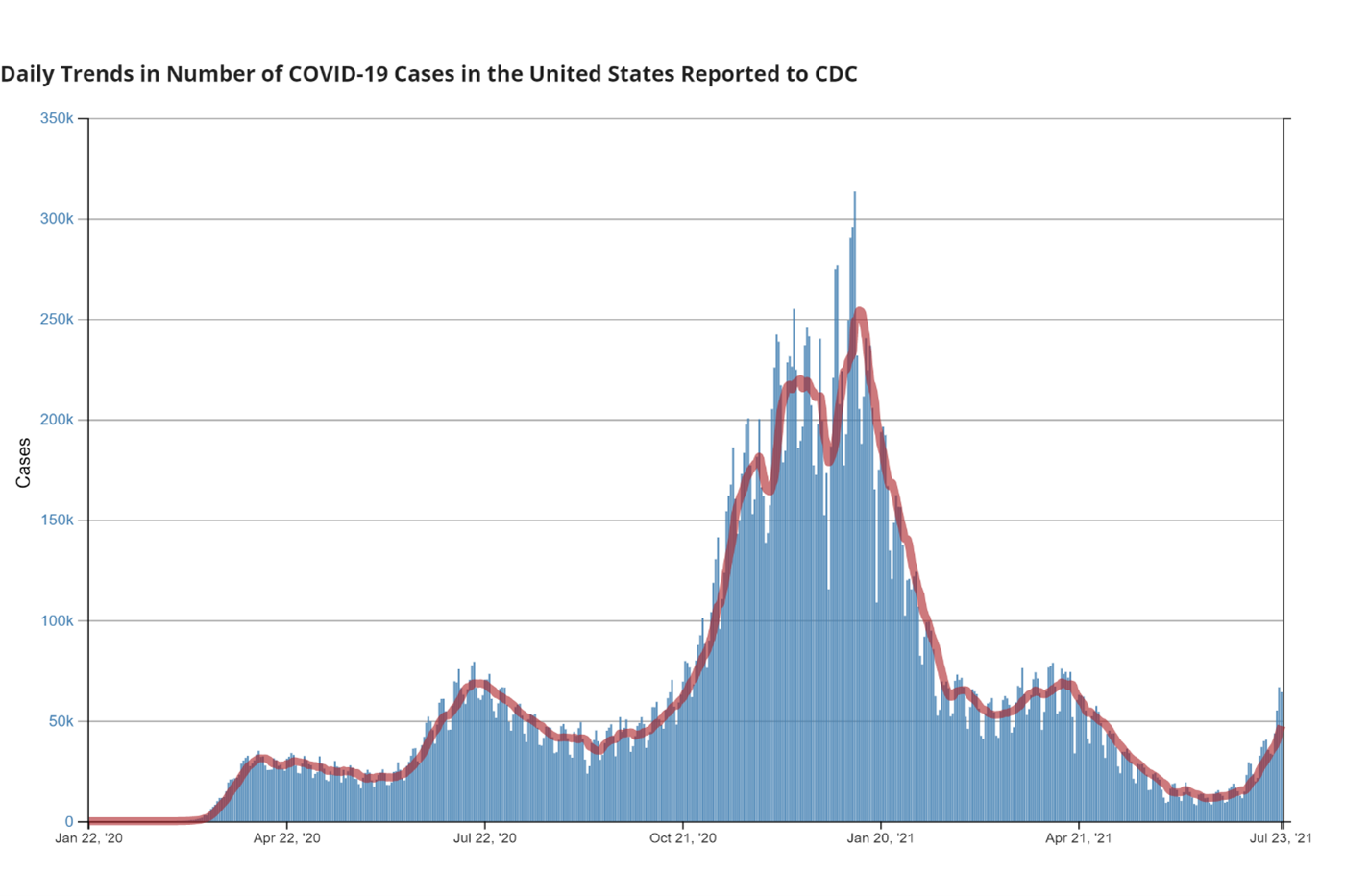

The Delta variant of COVID-19 is spreading across the U.S., leading to a sharp rise in infections and hospitalizations in recent weeks. The Delta variant, which was first identified in India, is highly contagious and has quickly become the dominant variant in the U.S.

So far, vaccines have held up well in protecting against the Delta variant. Thus, the surge in cases we’re seeing is largely among the unvaccinated population (about 40% of Americans age 12 or older).

This has sparked fears of another lockdown, which would cripple the recovering economy.

And there’s another variant from Peru—Lambda—that may be able to hide from the immune system. It has spread throughout Latin America, and the World Health Organization recently declared it a Variant of Interest.

Summing it all up

Given everything we know, I estimate that we will see elevated giving continue through the end of 2021. Charitable giving will then return to pre-COVID levels by Q1/Q2 of 2022. This is on par with what many others in the nonprofit industry predict for the coming months.

In the meantime, I’ll continue to recommend that nonprofits invest in their data strategy. Data is the key to everything when it comes to building a sustainable fundraising program.

Having the right data at your fingertips will allow you to make long-term strategic decisions as well as short-term pivots when emergencies—like global pandemics—happen.

Leave a comment: