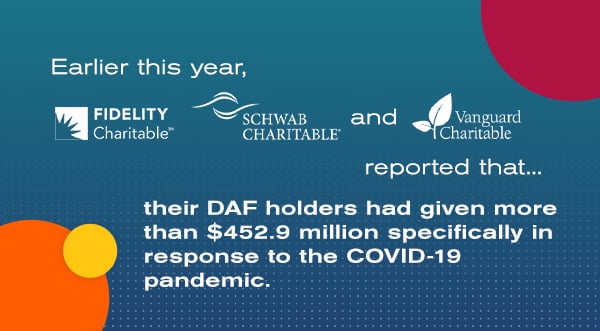

Donor-advised funds (DAFs) have grown in popularity over the last few years. In 2018, DAF contributions totaled more than $37.12 billion in revenue – that makes up 12.7% of individual giving for the year.

For the first time, these financial institutions are encouraging DAF clients to make a distribution.

However, there’s still a little bit of uncertainty surrounding DAFs due to the challenges of tracking and thanking the donors.

In this blog, we’ll take a look at how you can crack the code behind your DAF donations and how following up with them may differ slightly than with a traditional major donor.

UNCOVERING INFORMATION

DAF donors aren’t always as mysterious as they’re made out to be.

Granted, some of them choose to be truly anonymous, avoiding any recognition whatsoever.

But, at the very least, you’ll know the financial institution or adviser in charge of making the gift. This piece of information alone is more valuable than you might think.

From there, you can begin to ask around for more information:

- Can the financial adviser share any other information with you?

- Was one of your major gift officers, executive directors or event managers anticipating a gift for the same exact amount?

- Is there someone from your board who may know more details?

More often than not, someone in your organization will know the details you need to track down who gave the gift.

Decoding DAF donations requires a little bit of sleuthing, but these special donors are more than worth it.

HOW DAF DONORS ARE DIFFERENT FROM MAJOR DONORS

Before we get into the stewardship piece, we have to recognize the differences between this group and a traditional major donor segment.

Do they both give large gifts that could make huge differences for your mission? Yes. Should they both be thanked in a personal and meaningful way? Also, yes.

But the reason behind why DAF donors give is a little different.

Tax cuts may be your immediate assumption, but if that’s all they wanted, there are plenty of other ways to get there.

DAF donors are philanthropic by nature. They choose to take a portion of their money and put it away specifically for the purpose of helping nonprofit organizations. And, depending on how their financial institution or foundation works, the donor may release the decision-making to the adviser.

While many major donors feel the same, the key difference is that DAF donors aren’t in it for the “feel good” moment, especially if they choose to remain anonymous.

This is an important thing to keep in mind as we begin to follow up with them and thank them.

FOLLOWING UP WITH DAF DONORS

There are a few routes you can go when thanking and following up with a DAF donor, and it all depends on how much information you know about whomever made the distribution.

If they choose to remain anonymous and you can’t find any information about them, it’s still important to thank them through the financial institution or advisor.

They’ll usually pass your note along to whomever holds the account. But even better, you’ll begin to build a relationship with the foundation, institution or advisor. By passing along impact reports, thank-you notes and other stewardship pieces, your organization can be top of mind for any of their other clients looking to make a distribution in the future.

Obviously, the preferable route is that you know who gave the DAF donation. In this instance, stewardship is much like for a major donor. A meaningful and personalized thank you should be your starting point.

However, the tone of the message should feel a little different. Remember what we mentioned above? That they weren’t in it for the “feel good” moment like other donors? Keep that in mind throughout all communications.

Because DAF donors set their money aside specifically for charitable giving, they truly want to see the impact that their gift is making. As a nonprofit, it’s critical to demonstrate what you are accomplishing thanks to their generosity. Impact reports should be shared not only with the donor, but with their adviser or financial institution as well.

DAF donors can be a pivotal piece of any fundraising strategy if you’re willing to put in the extra effort. Don’t let the mystery surrounding DAF donors keep you from tracking, thanking and stewarding them just like any other. Trust me, it will be worth your time.

Leave a comment: