Inflation is back after a 40-year hiatus.

The cost of consumer goods in April 2022 was 8.3% higher than in April 2021—troubling numbers we haven’t seen since the days of double-digit mortgage rates in the 1970s.

Costs are up for nonprofits, too, with paper costs jumping 30% in the past year, not to mention higher labor costs for both nonprofit employers and service providers such as printers and mailers.

How should nonprofits approach fundraising in these uncertain times?

It may be tempting to cut spending and pull back on fundraising to save costs. But that is rarely the right approach in response to any change in the market, whether the problem was COVID-19 in 2020 or inflation today.

The most obvious reason for sustaining and, if possible, even growing your fundraising efforts is because the needs your nonprofit exists to solve don’t go away when inflation sets in. Depending on your cause, inflation can mean the need for your nonprofit’s services is greater than ever, especially if you are in the social services sector. Hard times mean more people need help:

People who can’t afford to pay their rent and lose their apartment.

People who had to put a few items back on the grocery store shelf and might go to bed hungry tonight.

People who are feeling a little extra stress and don’t know where to turn.

That means you need to keep your fundraising going to be able to respond to those needs, and an over-focus on cost containment can lead to service containment.

Not only that, but many donors also stand ready to help in times of need, so don’t take away that opportunity. Cutting costs will hurt you now and later.

Over the years, I’ve seen more than one example of a nonprofit that trimmed back their individual giving program and then complained a few years later of a startling reduction in the number of bequests. What’s the connection? A certain percentage of smaller donors move up to become larger bequest donors. If you stop mailing those smaller donors, some of them simply won’t be there a few years later when they otherwise might have made a significant gift.

Therefore, don’t cut back. As inflation pushes up the price of everything, the solution is to optimize, not just cut. Be more strategic in your strategies and how you ask for gifts. For example:

1. Make sure your message is maximally relevant

Acknowledge this moment in your communications with donors. Empathize with what’s going on in their lives. Don’t be afraid to mention the impact of inflation on them, but also remind them of the impact on those you serve. Donors are moved to give by emotional stories, so tell those stories and make the case for giving—especially now when more people are struggling to get by.

2. Up your analytics game in acquisition

I’ve said many times before, and I’ll say it again: don’t cut your direct mail and digital new-donor acquisition to save money. Cutting acquisition is a terrible idea and will come back to haunt you.

- You’ll lose the influx of new donors now

- You’ll lose annual gifts in the following year

- You’ll lose legacy and major gifts years down the road

Leverage the power of advanced analytics to optimize your approach to acquisition. Fine tune your program to focus on acquiring higher-value donors who will be more deeply committed to your cause for a longer period. Likewise, you can use digital media to target specific behavioral and demographic attributes in new donor acquisition.

This will help you save costs without forfeiting your future.

3. Redouble your efforts toward mid and major donors

There is one group for whom the inflation impact is less acute—the upper middle class and wealthy. These donors make up your mid-level and major donors, and now is a great time to make sure your major gift officers are cultivating relationships and gifts from this valuable cohort.

Remember: Mid-major donors are focused on solving problems. They want to help on a broader scale, so appeal to them with a plan for how their gift will help your mission during uncertain, inflationary times.

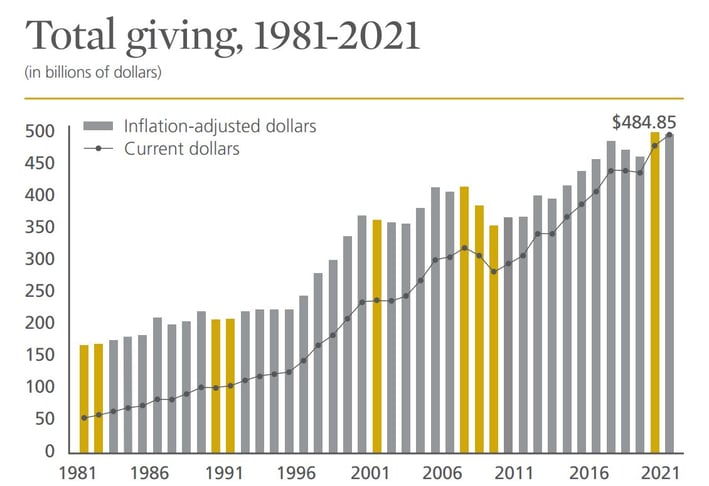

Through so many difficult periods over decades, charitable giving has remained remarkably consistent. Just look at the steady growth over the last 40 years in the chart below.

Source: Giving USA

Those organizations who stay in market during the tough times always emerge stronger than those who pull back and cut their fundraising efforts. This was true at the start of the pandemic and in the face of a supply chain crisis. It’s also true now in the reality of inflation.

Stay strong and don’t miss out. Your mission depends on it.

Leave a comment: